Art by Land or Sea: Valuing, Appraising and Transferring Your Art Collection

Insights from Northern Trust Wealth Management

Many yacht owners are also art collectors, driven by a passion for the creative works they spend years educating themselves on, pursuing, acquiring and displaying. And just as the pleasure and satisfaction of owning a yacht come with significant financial implications, financial considerations are also a cornerstone of successful collecting — and inseparable from your intentions for the collection. For serious collectors, tax and estate-planning considerations have a meaningful impact on other goals.

How do you value art?

Anyone who has had a yacht surveyed is acquainted with the types of difficulty that exist in valuing art: With no public, regulated, transparent, full-time market, valuation is complicated compared with investments such as publicly-traded securities or real estate.

Valuation is generally determined by the following factors:

Authenticity: Authenticity is verification that the work is both genuine and made by the designated artist, and it is the starting point for determining a piece’s value. For significant purchases, buyers should conduct independent due diligence through an independent expert.

Provenance: Provenance refers to an artwork’s ownership history, auction records, conservation records, certificates and bills of sale, and it is integral in establishing authenticity. Provenance can help establish that the work was not, at any point, obtained illegally. In some cases, such as prior celebrity ownership, a work’s provenance can add value.

Title: Title refers to ownership of property that is free of claims against it. A piece of artwork could, for example, be subject to liens, serve as security for a loan or be subject to a legal claim. It is critical that, in transferring ownership of art, you can defend its title. Note, however, that title is not proof of authenticity.

Rarity: The rarity of an art object can translate into higher value.

Condition: Maintaining a work’s condition is crucial to maintaining its value. Musty rooms, direct sunlight and display over fireplaces can compromise a work’s condition over time, even if it appears flawless to the naked eye.

How is art appraised?

Beyond knowing how much a work or collection is likely to sell for on the market at a given point, an appraisal is also essential for insurance and tax purposes. While the nuances of appraisal differ for each assessment, all entail enlisting the service of a qualified appraiser who can prepare an appraisal report according to the Uniform Standards of Professional Appraisal Practice (USPAP).

Insurance appraisals are generally based on retail replacement value (RRV), or the amount it would cost to replace an item with one of similar quality in a retail venue in a reasonable period. The RRV will likely be higher than fair market value, which is used for tax purposes because it is the price one would pay to replace the item at retail.

Unlike the RRV used for insurance purposes, the value for tax purposes is the work’s fair market value at the time of the transfer, either during life or at death. This value is based on a hypothetical sale in the market where the artwork is most commonly sold to the public — at auction.

The Smithsonian Institute recommends consulting the American Society of Appraisers, Appraisers Association of America or International Society of Appraisers for membership directories. Remember that it is essential to enlist the services of an appraiser with expertise in the relevant type of artwork.

What can I do with my collection?

When planning to transfer their art, collectors generally choose to transfer the collection the same way you may think of transferring a yacht: to family, charity or sale. These strategies can be combined to achieve the desired outcome with an art collection.

Transfers of art can also be made through trust vehicles. Although this can provide financial and control advantages, doing so presents several practical challenges and is generally more complex than gifts or bequests.

Northern Trust is proud to be presenting sponsor of EXPO CHICAGO. Read more about the art of collecting at www.northerntrust.com.

Transfer the collection to the family.

Both lifetime gifts and testamentary bequests, upon death, have varying financial and non-financial advantages. From a tax planning point of view, the critical distinction is that gifts are subject to the gift tax, while bequests are subject to the estate tax.

You can gift significant amounts of art during life free of transfer taxes. In addition to the $16,000 annual gift tax exclusion allowed every individual, you can transfer assets (including liquid assets, real property and tangible personal property) with a total value up to the applicable exclusion amount of $12.06 million ($24.12 per married couple), during life or at death, without federal transfer tax consequences. (Transfers exceeding the exclusion amount incur a maximum of 40% federal transfer tax.)

A primary advantage is that the gifted artwork will not be included in your estate, reducing potential estate taxes upon death. However, your tax benefit comes at a cost to the recipient: She must use your tax basis (the purchase price or fair market value, whichever is lower) upon future disposition to compute gain or loss for federal income taxes. That is, when she sells appreciated art, she must pay federal and perhaps state capital gains tax on all of the appreciation in the art’s value, not just the post-transfer appreciation.

Conversely, if you were to wait to transfer the art at death, the recipient could receive a new fair market value basis in the art. When included in your taxable estate, the collection’s tax basis is generally the fair market value at the date of your death or alternate valuation date. Depending on your family’s goals for the collection, holding the collection until death and having your executor or trustee provide for disposition may be a workable option.

Transfer the collection to charity.

Collectors often donate their artwork to charity because they desire to support specific organizations. In addition, many donors are interested in obtaining a charitable deduction for income, gift or estate taxes. To optimize tax benefits, donors must consider many factors. For federal income tax purposes, the charitable deduction amount depends on the type of property contributed, the type of recipient and how the recipient intends to use the property.

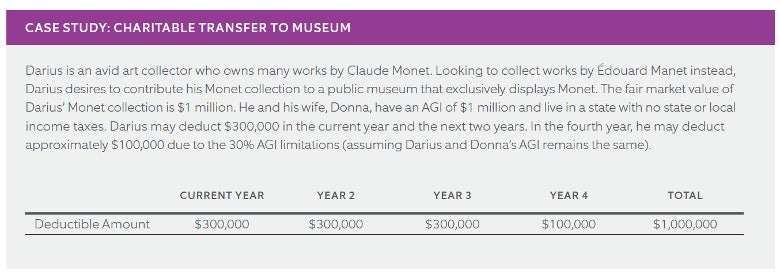

Art held by collectors and investors for more than one year is generally considered long-term capital gain property; income tax deduction for donating the long-term capital gain property to public charities is usually based on the fair market value of the property, and donors may deduct up to 30% of their adjusted gross income (AGI). By contrast, the income tax deduction for a donation of long-term capital gain property to a private charity is based on the property’s tax basis (usually the cost). It is deductible up to 20% of the donor’s AGI.

Charitable transfers at death are not subject to extensive tax deduction requirements (such as AGI limitations and the related-use test) as transfers during life. Instead, transfers at death are eligible for unlimited federal estate tax deductions. A charitable transfer at death allows you to benefit from full ownership of the collection during life. It may allow your estate to obtain an estate tax charitable deduction based on the fair market value of transferred items.

Sell the collection.

Last, a collector may wish to sell all or a portion of the collection — again, either during lifetime or by their executor at death. There are many different reasons that may drive the collector to sell: for example, diversification of the collection, increased liquidity to acquire new pieces or payment of taxes.

Relative to other assets, art can be expensive to sell due to costs such as auction house fees, sales commissions, insurance, taxes and shipping. If your collection grows in value, it is important to develop strategies to minimize the tax costs of a sale or exchange — which is largely dependent on the timing and relationship between the taxpayer and the art. Whether you are classified by the IRS as a collector or an investor will determine income tax rates and deductions. Work with your financial advisors to make these determinations.

The most common ways to sell a piece or collection when or if the time comes are:

Auction: The most familiar method of sale to many, auctions are based on transparent bidding. Works sold at auction typically receive a free auction estimate, and most also carry a reserve price — the minimum price a seller will accept — known only to the seller and auction house.

Private Gallery or Sale: In some cases, those who wish to remain anonymous will opt for a private sale; in others, the auction cycle does not match the parties’ required timeline, or a work can realize stronger prices through private sales than at an auction.

Northern Trust takes a personalized approach to helping you define your objectives and build a plan to ensure the ongoing protection and preservation of your art collection. Whether you are contemplating decisions surrounding a collection ashore or thinking about what to display on your yacht, explore more insights at Northern Trust’s Art of Collecting.

Read Next

Navigator Newsletter Stay informed on all things yachting and luxury lifestyle with the bi-monthly Navigator newsletters.